How does tax work and does the government have a effect on it?

Thanks for your question.

Tax is money charged by a government on items such as wages or goods and services, to provide money for government services. Taxes are paid by people and businesses in Australia and include:

- The Goods and Services Tax (GST)

- Other taxes, such as company tax

- Custom charges (taxes on goods entering or leaving the country)

The Australian Government uses this tax money to pay for running the country, such as Australia’s defence force, national parks, pension payments and interstate railways.

Each year the Australian Government details how it plans to collect taxes and spend tax money in a set of documents called the Budget. The Budget details:

- how the government intends to raise money.

- how much money is expected to be raised.

- how the government intends to spend this money.

The Budget documents are prepared by the Treasury Department and presented to the Australian Parliament by the Treasurer. They begin the process early each year. The Treasurer works with other ministers to develop spending policies for each government department.

Federal Budget process

Parliamentary Education Office (peo.gov.au)

Description

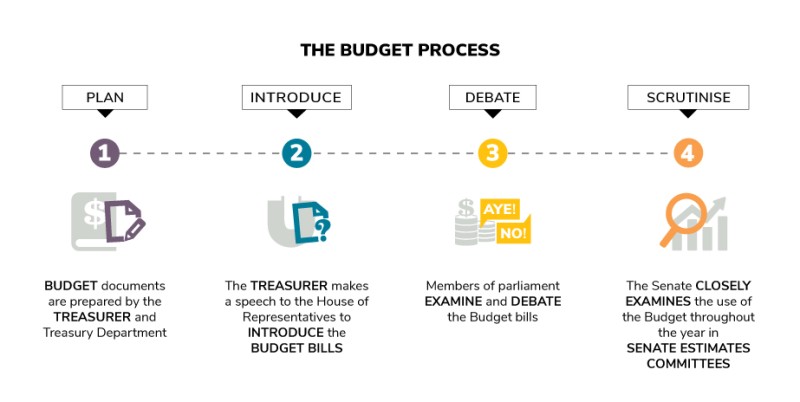

This diagram illustrates the development and operation of the Budget:

- Budget documents are prepared by the Treasurer and Treasury department.

- The Treasurer makes a speech to the House of Representatives to introduce the budget bills.

- Members of parliament examine and debate the Budget bills.

- The Senate closely examines the use of the Budget throughout the year in Senate estimates committees.

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported License.

You are free to share – to copy, distribute and transmit the work.

Attribution – you must attribute the work in the manner specified by the author or licensor (but not in any way that suggests that they endorse you or your use of the work).

Non-commercial – you may not use this work for commercial purposes.

No derivative works – you may not alter, transform, or build upon this work.

Waiver – any of the above conditions can be waived if you get permission from the copyright holder.