Income Tax (War-Time Arrangements) Act

07 June 1942

Australia introduces uniform rates of income taxation.

In 1901 most government income came from tariffs and customs duties, which the Commonwealth – Australian government – controlled. Income taxes were collected and controlled by the states and were small in comparison.

Due to the huge costs of the Second World War the Commonwealth needed more money which could be raised by collecting income tax at the same rates across the country. The states transferred control of income taxes to the Commonwealth. The states in return would receive grants from the Commonwealth. In 1957 the High Court of Australia decided the Commonwealth had the power to decide how the states spent these grants.

Although originally intended as a wartime measure, the Commonwealth alone has continued to collect income tax and distribute the money to the states, significantly shifting the balance of power between the federal and state levels of government.

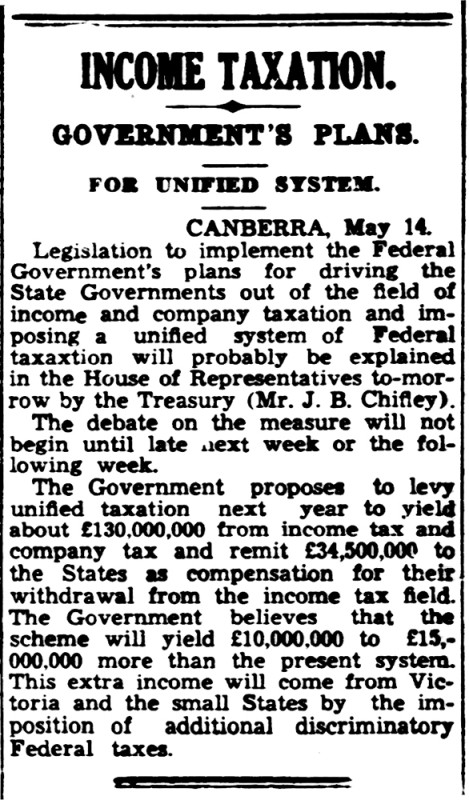

Cairns Post, 15 May 1942

National Library of Australia

Description

A newspaper article published in the Cairns Post, 15 May 1942. The article is called 'Income Taxation- Government's Plans for Unified System.' This article describes the Government's plan to introduce a national uniform income tax rate.